Firms Offering Social Security Advice Scramble To Update Systems

The elimination of two popular Social Security claiming strategies has left companies that offer Social Security advice scrambling to incorporate the new rules into their systems.

Last week, Congress put an end to “file and suspend” and a restricted application for spousal benefits—Social Security strategies that together made it possible for both members of a couple who are 66 or older to...

Possible Indicators Of Elder Financial Abuse

It is a common concept to want companionship, and elders are no exception. Unfortunately, an elder with diminishing capacity can easily become a victim of financial abuse if they and/or their advocates are not careful to watch for the indicators of elder mistreatment. Here are a handful of possible indicators of elder financial abuse to be aware of and look for:

Unpaid bills, eviction...

Estate Tax Exemption for 2016

Good News!

Recently, the Internal Revenue Service (IRS) announced the new limits for estate and gift taxation. These are the amounts that you can give tax free during life or at death in your will or living trust. Unfortunately, the annual gift exclusion stays at $14,000 – the amount that you can give (per person, per year) without having to file a Form 709 gift tax return. This means a...

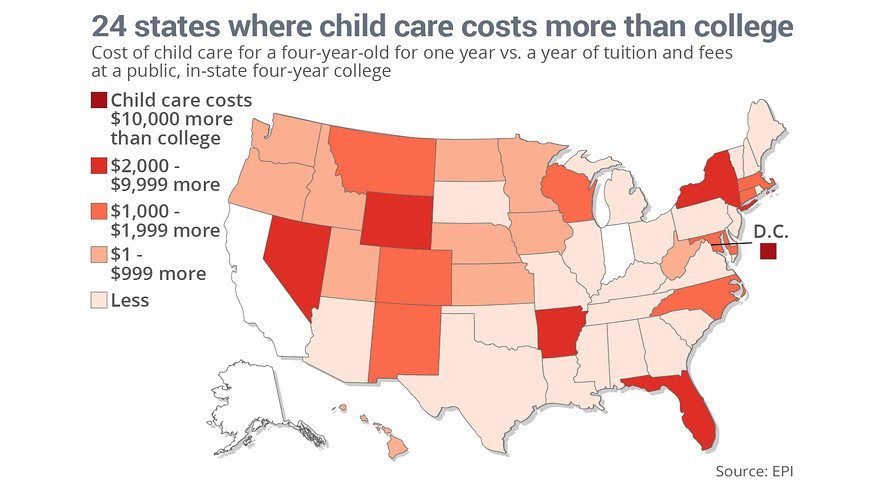

24 states where child care costs more than college

While the astronomical (and rising) cost of college seems to garner all the media attention, it’s the cost of child care that should be more worrying for many parents.

Nearly 11 million children under the age of five require child care at least weekly and spend an average of 36 hours a week in child care — and for the parents footing the bill, this can make a serious dent in their finances.

In...

Portability – The great estate tax break

You can’t take a tax break with you, but it’s becoming easier to leave to your beneficiaries. The IRS released final rulings detailing an estate and gift-tax break for married couples, known as “portability”. It allows a married spouse to pass nearly $11m in assets to heirs, free of estate tax. Without this, couples would only qualify for one exemption, as opposed to two.

The exemption,...